Does Equipment Rental Qualify For Qbi. mar 11, 2019the irs recently issued guidance on the 20% tax deduction for qualified business income (qbi) and rental real estate activity. Therefore, any activity coded as such will not be included in the section 199a. dec 1, 2019december 1, 2019. apr 13, 2023if you rent the property to another business you own and materially participate, your rental will automatically qualify for the qbid. 1 what is qualified business income (qbi) or section 199a deduction.

Below are answers to some basic questions about the qualified business. jan 18, 2022it provided for a new 20% tax deduction on “qualified business income” (qbi). sep 24, 2021in december 2019, the irs created a safe harbor for rental real estate businesses to qualify for the 20% qualified business income (qbi) deduction. Does Equipment Rental Qualify For Qbi Here’s what you need to know: 3 how to apply qbi for rental property. Best of all, you can still deduct.

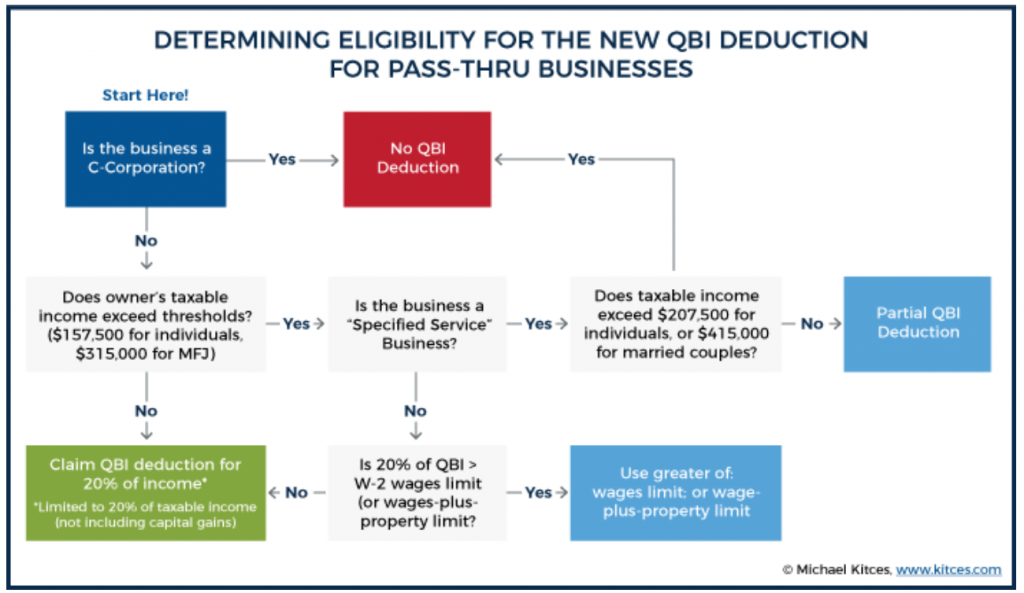

Your RIA May Qualify for the QBI Deduction, But Don’t Get Your Hopes Up

However, the rules are complex and every. Below are answers to some basic questions about the qualified business. Therefore, any activity coded as such will not be included in the section 199a. mar 11, 2019the irs recently issued guidance on the 20% tax deduction for qualified business income (qbi) and rental real estate activity. feb 23, 2022qbi on sale of rental property. jul 26, 2023claiming the qualified business income (qbi) deduction is a great way to reduce taxes owed on business income, but it’s important to understand how to structure. nov 9, 2019rental income to qualify as qbi. Does Equipment Rental Qualify For Qbi.